Understanding the Shift: HMRC’s Evolving Approach to Crypto Compliance

Cryptoassets have fundamentally altered the financial landscape in the UK. Most importantly, these digital assets are not only innovative but also challenging for traditional regulatory frameworks. Because of this, HM Revenue and Customs (HMRC) is compelled to develop dynamic strategies to monitor, track, and enforce tax compliance.

In recent years, increased digital transactions have pushed authorities to implement advanced methods for oversight. Therefore, HMRC now emphasizes real-time data analytics and proactive investigations. Besides that, the rapid evolution of crypto markets necessitates adaptive and robust regulatory measures to keep pace with emerging threats.

The New Regulatory Landscape: CARF, Enhanced Reporting, and Global Cooperation

The upcoming implementation of the Organisation for Economic Co-operation and Development’s (OECD) Crypto-Asset Reporting Framework (CARF) from 1 January 2026 starkly highlights the changing regulatory environment. Because of CARF, both users and providers of cryptoasset services, including exchanges, brokers, and dealers, are required to submit comprehensive identifying information. This step is critical to deterring tax avoidance and enhancing transparency. For further details, refer to Charles Russell Speechlys.

Furthermore, new guidelines have spurred collaborations between HMRC and international partners. Most importantly, this global cooperation ensures that data sharing and coordinated audits are integral parts of the enforcement process. As a result, the framework not only simplifies regulatory oversight but also amplifies the magnitude of legal recourse against evasive practices.

Why Data and AI Matter in Fighting Crypto Tax Fraud

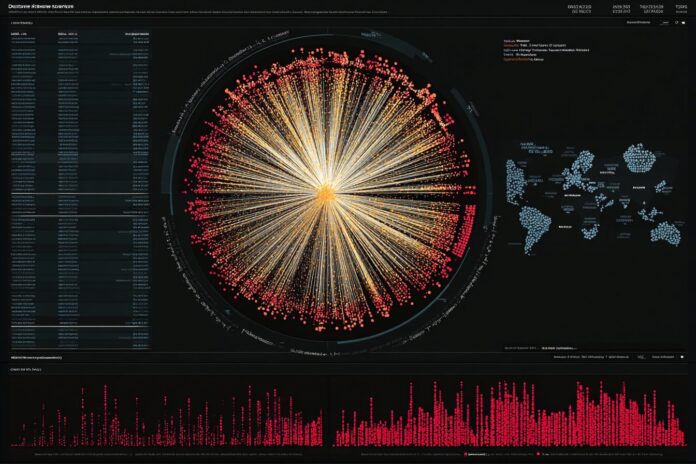

HMRC’s strategy now prominently features the use of data analytics and artificial intelligence (AI) to clamp down on crypto tax fraud. Most importantly, these technologies enable authorities to sift through vast datasets quickly, identify irregularities, and pinpoint fraudulent activities. Because crypto transactions often involve pseudonymous addresses, AI becomes indispensable in bridging the gap between digital anonymity and regulatory transparency. For more insights, explore the analysis by Chainalysis.

Additionally, advanced data models are integrated into HMRC’s auditing procedures. Therefore, the new system not only streamlines the process but also minimizes the risk of oversight errors. Besides that, deploying AI allows for near-real-time monitoring of transaction anomalies and provides deeper insights through automated risk assessments.

How Data and AI Work Together to Combat Fraud

The synergistic use of data and AI forms the backbone of HMRC’s modern enforcement strategy. Most importantly, AI-driven pattern recognition helps detect unusual transaction behaviors, such as abrupt high-value transfers or transactions involving high-risk regions. Because these models analyze millions of transactions, they can highlight potential fraud almost instantaneously.

Moreover, network analysis is employed to construct detailed transactional graphs. As a consequence, HMRC can visualize entire transaction webs, linking wallet addresses, exchanges, and individual actions. This method not only uncovers multi-layered evasion schemes but also provides clear trails for legal scrutiny. Therefore, automated reporting has transformed the compliance landscape as it processes structured data and flags discrepancies. For regulatory perspectives, see insights by inTAX.

Impact on Investors and Crypto Service Providers

For investors, these developments signify an end to the era of unmonitored transactions. Because HMRC now considers crypto-for-crypto exchanges, gifts, and even rewards from mining and staking as taxable events, the scope of compliance is greatly expanded. Most importantly, this shift means that any attempt to operate under the radar carries significant financial risks. Detailed guidance on these obligations is available from sources like Blockpit.

On the other hand, crypto service providers are facing increased scrutiny as part of their new compliance requirements. Therefore, these providers must update their systems to prevent tax evasion actively. Besides that, failure to comply might not only result in severe penalties but also expose companies to corporate criminal prosecution. Such stringent measures reinforce the importance of adhering to HMRC’s evolving guidelines, as highlighted by Osborne Clarke.

Key Features of HMRC’s Modern Enforcement Framework

HMRC’s revamped framework is built on several key pillars that leverage both technology and cooperation. Most importantly, the expanded data collection process mandates that crypto service providers submit detailed customer information. Because this additional data enables better matching of transactions to taxpayers, the overall transparency of the system is greatly enhanced.

Furthermore, the deployment of AI tools by HMRC’s Fraud Investigation Service greatly improves its ability to detect, investigate, and prosecute fraudulent activities. Therefore, any anomalies in crypto transaction patterns are addressed promptly with a data-driven approach. This comprehensive system benefits from global collaboration, ensuring that efforts to combat tax evasion are coordinated across borders.

Preparing for Compliance: Practical Steps for Investors and Service Providers

It is crucial for both investors and crypto service providers to be proactive during this transition period. First, maintain detailed records of all transactions, including wallet addresses, dates, and corresponding fiat values. Most importantly, these records help in substantiating any claims or responses during audits.

Additionally, engaging with reputable cryptoasset service providers who are already updating their systems for CARF compliance is imperative. Because detailed compliance enhances transparency, it also minimizes risks associated with potential penalties or legal actions. Therefore, staying updated on HMRC announcements and consulting with specialized advisors can streamline the adjustment process. This proactive approach is further supported by guidance found on industry platforms such as Charles Russell Speechlys.

Looking Ahead: The Future of Crypto Tax Enforcement with Data and AI

The future of crypto tax enforcement is poised for significant transformation. Most importantly, the integration of data analytics and AI not only boosts HMRC’s capabilities but also sets new industry standards. Consequently, as digital assets continue to grow, these tools will play an essential role in creating a transparent and accountable financial ecosystem.

Because both technology and regulatory strategies are rapidly evolving, investors and service providers must adapt quickly. Therefore, the emphasis on transparency and compliance will only intensify, ensuring the long-term sustainability of the digital economy in the UK. Besides that, the collaborative model between regulators and technology experts stands as a blueprint for future financial oversight, encouraging innovation and resilience in policy enforcement.

References:

– Charles Russell Speechlys: New tax reporting requirements for users and providers of crypto asset services

– Chainalysis: Tackling Crypto Tax Fraud with Data & AI

– Osborne Clarke: Crypto exchanges face increased risk in UK for failing to prevent tax evasion by investors

– inTAX: HMRC Cryptoasset Reporting Rules and Their Impact

– Blockpit: Crypto Tax UK – Ultimate Tax Guide for 2025