Is History Repeating Itself in Tech?

In recent months, leading economists and market experts have warned that the current AI boom might be far more speculative than the dot-com craze of the late 1990s. Investors’ excitement over burgeoning artificial intelligence technologies seems to be driven more by optimistic projections than by solid fundamentals. Because expectations remain sky-high, many compare this phase to a doomed bubble waiting for a burst.

Most importantly, the rapid surge in tech valuations has raised serious questions about long-term sustainability. Experts draw parallels with the dot-com era, where inflated stock prices eventually led to massive corrections. As noted by Fortune, these concerns are intensified by extraordinary price-to-earnings ratios, which are seemingly detached from company performance. Therefore, investors must tread cautiously as history warns that market exuberance, when unchecked, can lead to catastrophic outcomes.

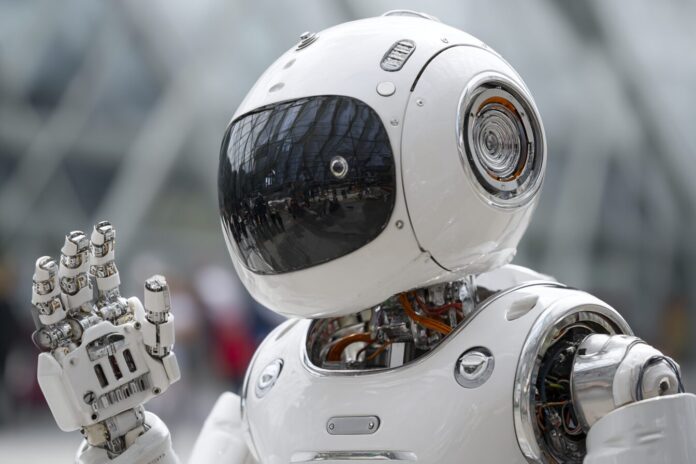

The Hype Machine Hits Overdrive

The contemporary hype cycle is reminiscent of the fervor seen during the dot-com bubble. Many investors are currently caught up in the excitement, precipitating a surge in mega-cap tech companies. Because of this enthusiasm, companies such as Nvidia, Microsoft, and Apple are trading at exorbitant valuations that remind seasoned investors of a past market meltdown. Besides that, calculated risks taken by some are being influenced more by emotion than by evidence-based analysis.

Furthermore, the current scenario is bolstered by an influx of capital that breeds not only optimism but also unsustainable price speculation. Transitioning from cautious strategies to aggressive investments, market participants are increasingly influenced by Fear of Missing Out (FOMO). As highlighted by TechSpot, the role of investor psychology cannot be underestimated in this renewed frenzy of tech mania.