Bitcoin Enters a New Phase: Stability in the Spotlight

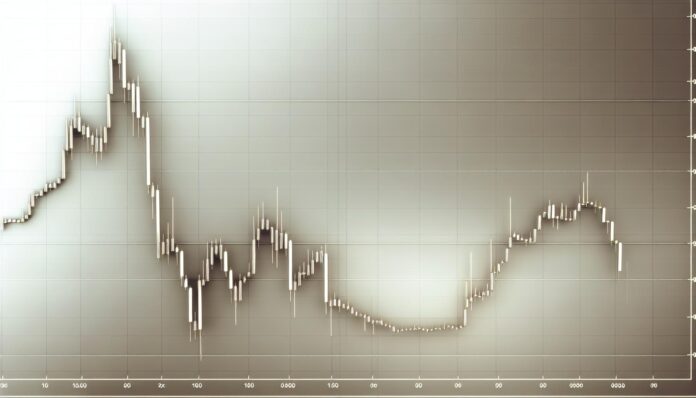

For years, Bitcoin has been synonymous with rapid price swings and dramatic market narratives. Most importantly, recent trends highlight a more stable environment, as Bitcoin’s annualized volatility has fallen to historic lows, reminiscent of the pre-pandemic era of 2020. This period of calm, marked by a BVOL as low as 40, is a clear sign that Bitcoin is stepping into a mature phase. Because stability now drives investor interest, the cryptocurrency market is witnessing a transformation in both perception and performance.

Besides that, this newfound stability is reshaping investment strategies. Institutional investors, bolstered by their own risk management practices, are increasingly viewing digital assets as a credible store of value. As detailed in an analysis by AInvest, the shift towards lower volatility is inextricably linked with strategic asset allocation decisions by institutional players. This trend underscores the crypto market’s evolving role from a speculative arena into a robust investment option for diversified portfolios.

Why Is Bitcoin’s Volatility Dropping?

There are multiple factors driving this significant drop in volatility. Most importantly, an increasing institutional surge into the market has meant that large volumes of capital now flow into Bitcoin with considerable steadiness. Because these investors typically employ long-term strategies, their moves tend to dampen the wild price fluctuations that once defined the crypto market. Furthermore, detailed studies like those at Cointelegraph illustrate that this calmer environment is a direct consequence of a shift in market dynamics.

Moreover, exchange data shows a notable reduction in short-term inflows, as long-term holders continue to accumulate Bitcoin. This reluctance to engage in panic selling or rapid buying stabilizes the market and minimizes dramatic price moves. A recent report on Blockchain.News confirms that lower drawdowns—only a 33% peak compared to historical highs—are a central feature of the current bitcoin cycle. Therefore, both macroeconomic conditions and investor behavior are now converging to create a more secure and predictable price action landscape.

What Does This Mean for Bitcoin’s Price Action?

As volatility drops, Bitcoin’s price action reflects a more orderly and sustained growth trajectory. Since November 2024, the price of Bitcoin has appreciated from $70,000 to over $118,000, marking a significant 68% increase. Instead of rapid spikes driven by speculative fervor, price movements have become more methodical. Because investors now favor prudent strategies over quick wins, the market exhibits gradual, controlled price ascents.

This gradual pace is particularly significant for both individual and institutional investors. Most importantly, a lower risk of dramatic downturns translates into a safer investment environment. As noted by Tokenpost, the upward trajectory, albeit slower, encourages long-term holding and strategic planning. Consequently, this new phase brings a dual benefit of improved investor confidence and reduced market unpredictability, setting the stage for sustainable growth.

The Impact on Portfolio Strategy

The current environment presents a host of opportunities for both long-term holders and institutions. Most notably, a stable market means that Bitcoin can be integrated more reliably into diversified investment portfolios. Many institutional investors are now viewing Bitcoin as a strategic asset, comparable to traditional hedges like bonds and even gold. Because volatility is subdued, risk-averse investors are less likely to experience the undue stress associated with rapid price histograms, making it an attractive proposition for steady investment.

Besides that, portfolio managers are increasingly adopting strategies that revolve around risk management and long-term growth. With Bitcoin’s milder drawdowns, investors can now take advantage of trend-following strategies or a simple buy-and-hold approach without the constant worry of market crashes. This measured environment is further supported by data from Glassnode, which offers insights into ongoing market trends and helps refine investment decisions. Therefore, the evolving market conditions are fostering a more disciplined and calculated investment landscape.

What Is Driving This Market Maturity?

Several factors are contributing to Bitcoin’s ongoing market maturity, creating a foundation for gradual yet steady growth. Most notably, the growth of sophisticated derivatives, such as options and futures, has provided a means for institutions to hedge and manage risk more effectively. Because these financial instruments offer methods to smooth out volatility, they play a crucial role in moderating price swings as observed in recent periods.

Additionally, a growing number of investors is shifting from a short-term speculative mindset to a long-term, buy-and-hold strategy. This demographic change has led to increased stability, as coins are now largely held by investors with a view towards future returns. As a result, market fluctuations become less severe, and Bitcoin begins to mirror the stability seen in traditional asset classes like stocks and commodities. This evolution reflects a broader trend towards market maturity and strategic asset allocation, as noted by various industry analyses.

Will the Trend Continue?

Analysts predict that Bitcoin’s calmer volatility will persist as its role as a digital store of value strengthens. Most importantly, industry experts like Arthur Hayes have forecasted that Bitcoin could potentially reach a price of $1 million by 2028. Because such predictions are based on solid trends and the gradual integration of Bitcoin into diversified portfolios, investors can be cautiously optimistic.

Therefore, while the era of explosive, short-lived rallies may be behind us, the steady pace of growth promises long-term gains and a more predictable frequency of market corrections. This measured progression is expected to boost confidence among traditional investors, allowing Bitcoin to gradually secure a place alongside stalwart assets such as bonds and precious metals. As market maturity deepens, the dynamics of Bitcoin investing will increasingly reflect conventional financial principles, thereby promoting stability across broader investment portfolios.

Key Takeaways

Bitcoin’s transition into a lower-volatility asset marks an inflection point in its history. Most importantly, its stabilization is fueled by consistent institutional flows and refined portfolio strategies that emphasize long-term gains over rapid, speculative profits. The integration of Bitcoin into traditional portfolios illustrates its newfound role as a strategic asset in modern finance.

Because the current trend favors slower yet sustained climbs in price, investors now need to adjust their expectations and strategies. This maturing market environment not only enhances risk management but also offers the potential for steady wealth accumulation over time. With these insights, investors are better positioned to navigate the complexities of the crypto market in a calm, methodical manner.

References

- Bitcoin’s Volatility Downturn and Institutional Surge – AInvest

- Bitcoin volatility lowest in 563 days – Cointelegraph

- Bitcoin (BTC) Volatility Declines – Blockchain.News

- Bitcoin Climbs to $118K as Volatility Falls – Tokenpost

- Volatility Tightens – Glassnode Insights